Keyword Cannibalization. Duplicate Content. Crawl Priority. All of these are inherently SEO jargon, which can downplay the significance of such problems to boards, exec teams, or senior management. These problems sometimes exist due to information architecture problems or issues with the CMS. However, keyword cannibalization can be the result of a much larger, strategic problem for a company. A problem that can significantly minimize realized revenue. Let’s step out of SEO for a moment and look at some economic aspects of such a problem.

A Near Zero-Sum Market

Search is simultaneously a long-tail system, allowing for a near infinite number of possibilities, and a hit-based market due to limited shelf space created by searcher behavior. On a keyword specific level, the hit-based market shows as user behavior keeps most searchers from moving far beyond the first page of results.

In this search market, a near zero-sum game is produced in two ways. First, traffic is split across a number of results, creating a number of winners and losers all sharing a piece of the pie. Granted, it’s not a perfect zero-sum, as users can bounce and return to the results. Additionally, Google creates a near zero-sum game by selecting a limited number of URLs for a particular domain. Again, this isn’t perfect, as there are various search verticals, site-links, and domain crowding in some SERPs. However, the typical behavior of selecting only one or two URLs to show leads to the zero-sum problem that creates keyword cannibalization. If one URL wins, all of the other URLs competing for visibility lose.

In a simple model, only one URL from your site can receive traffic, while competing for attention against 6 to 9 other results. This problem exists for both paid and organic search, as only one URL is going to get the traffic (a generalization).

These mechanics set the stage for strategic conflicts for a company looking to do business online.

Revenue Maximization By Resolving Cannibalization

Let’s step back and look a common example.

If you’re a bookstore, you release multiple editions of books in a time gated manner that helps you maximize revenue. The earlier hardback edition of a book can be sold at a higher price to less price sensitive customers. For example, hardcore Harry Potter fans who will wait at midnight for early access to the last book in the series are less sensitive to price. There is a group who is more than willing to pay this cost so they don’t have to wait for the paperback release.

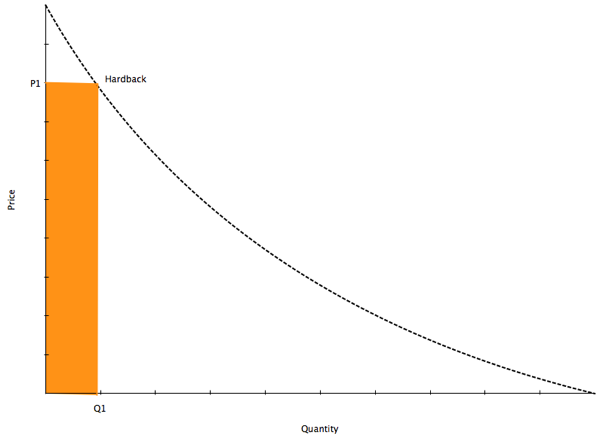

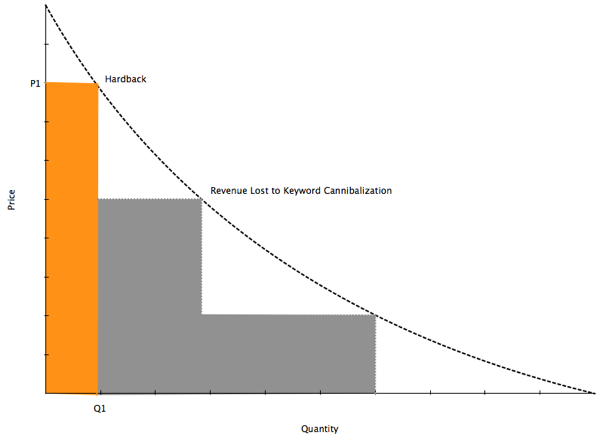

At the higher cost P1, there are Q1 potential customers. Roughly Q1 times P1, or the area under the curve, will give the revenue at this price point. This Q1 is also a proxy of the potential conversion rate at this price point.

However, look out to the right of the column to all that white space. That is unrealized revenue potential. There are a number of customers who are unwilling to buy the book at the original hardback price point.

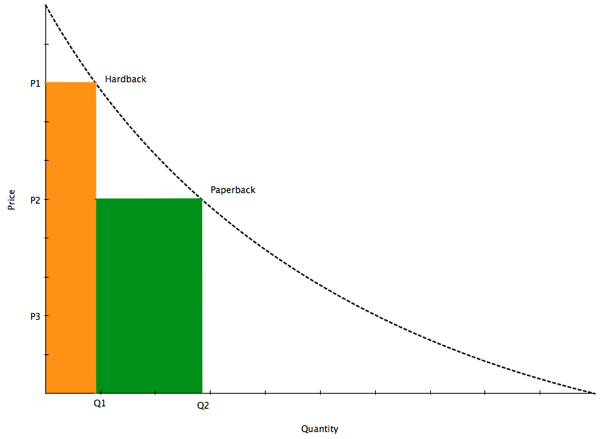

By releasing the paperback, at a lower price point, we can realize a greater amount of revenue by expanding out to Q2. At the new P2 price point, there is a larger number of customers willing to buy the book. This green area is incremental revenue available simply through the process of time gating and changing the consumption model. The core product, the content of the book, didn’t change.

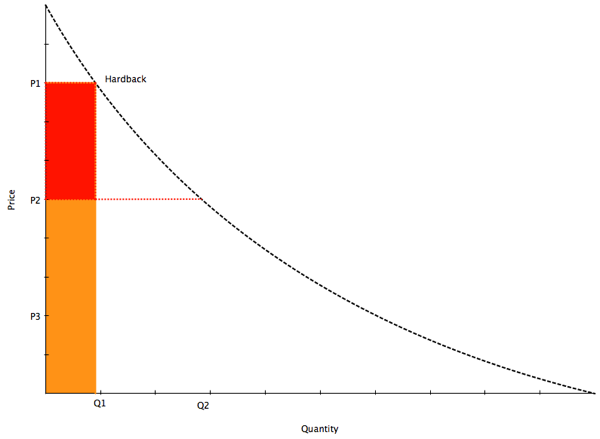

In the graph above, the red area is additional revenue gained that could have been lost if the book was released as a paperback, at the lower price point first.

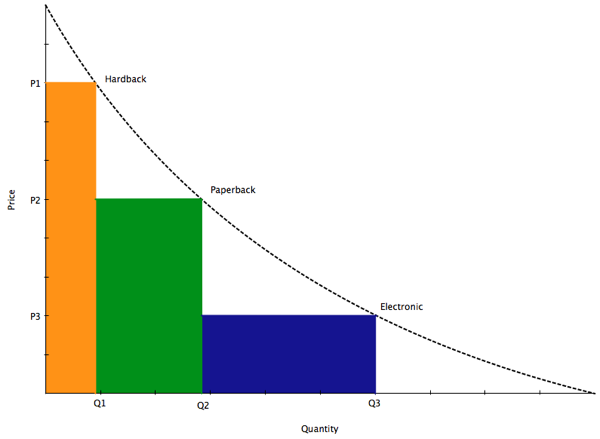

This model can go even further if it’s expanded out to an even cheaper consumption model, such as an electronic edition, like the Kindle or NOOK. (Granted these devices have higher entry costs, but once in the market, they allow access to a relatively lower cost, lower friction option.) Another example is Netflix streaming in the movie industry, which time gates with movie theaters, followed by DVD releases, followed by online download and streaming options.

This new model continues to maximize revenue by extending further out, capturing more area under the curve. (Granted, there is more at play here, such at different profit margins, potential cannibalization of revenue, paradox of choice, and different consumer tastes, but I’m keeping it simple.)

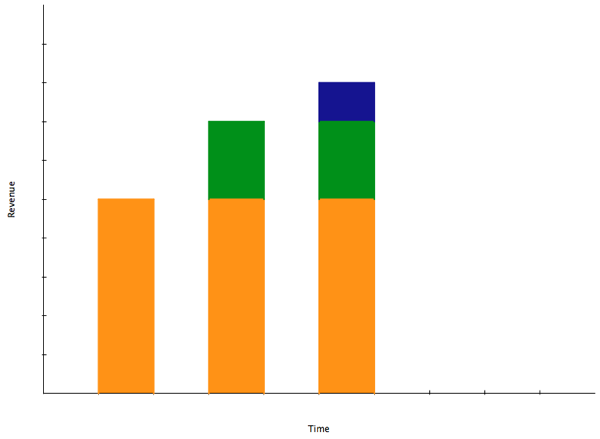

Over time, the revenue for the product may look like this.

Each incremental gain in revenue is realized each time a new price point or consumption model is introduced.

However, the mechanics of the search market place, as I described above, has the ability to break this model and prevent revenue maximization.

Search Induced Opportunity Cost

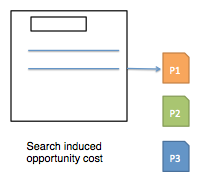

The nature of both the URL selection by Google and the nature of searcher’s decision making introduces both choice and scarcity. As a result, opportunity costs exist in instances of keyword cannibalization. The selection of a URL by Google and searchers means another URL (and its corresponding product) will not be selected.

In the bookstore model, it looks like this. Only one product URL appears in search results.

This can generate a problem for competing products or divisions. The growth of one division, that may compete on keywords with another division, means making an opportunity cost decision between the two divisions at a macro strategy level.

In our demand example above, this can cause the following problem (simplified of course).

The opportunity cost means traffic is being driven to the URL with only one product, at one price point. This is affecting conversion rates and is minimizing the shelf space of other product lines.

Once a bookstore releases its paperback edition, it may not fully experience the improved conversion rate and revenue maximization because the traffic is still landing on the hardback URL, at the higher price point. This can also play out by traffic only landing on the paperback edition, preventing access to the additional hardback revenue highlighted in red above. Although this is less of a risk, as the hardback edition is typically time gated.

For example, at Amazon, the owners of Kindle division may need to compete with the owners of the traditional book business for traffic, because both divisions are targeting the same keywords. Opportunity cost decisions are having to be made on where to spend paid search budget and where to drive traffic internally. (Amazon has done a relative good job resolving this with upsells and cross promotions on product pages.)

This makes keyword cannibalization a much larger strategic question for a company doing business online. With only one URL capable of capturing traffic, the Kindle division may have to take a backseat to the traditional book business. In organizations with thin margins, cash flow issues, or a high degree of risk aversion, keyword cannibalization can lead to division struggles / failures when not properly resolved.

However, it also means some organizations with a better understanding of search can have a competitive advantage against organizations squandering away traffic.

Granted, search is not the only channel online.

Equity Dilution

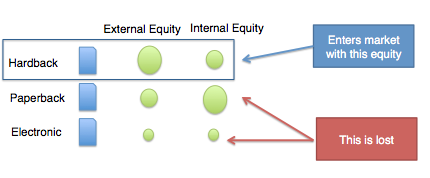

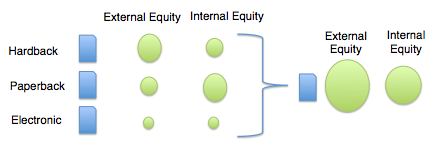

This opportunity cost extends across teams making decisions about where to invest marketing resources, especially if they exist at multiple URLs. Putting on your ranking equity hat, the problem starts to look like this.

Ranking equity is split across multiple URLs. The hardback URL may have significant external equity as it received the bulk of the marketing push at launch. It’s a challenging decision for an SEO to shift marketing efforts to the paperback URL, as the hardback URL already has the bulk of the equity. An SEO looking to increase revenue, improve conversion rates, and lower CPAs now has to outrank themselves on the work they did before. Long-term the paperback version may sell more units and get featured more prominently across the site, giving it more internal ranking equity. When Google makes the choice on which URL to present, it may not canonical these products to one URL. As a result, the hardback URL may enter the search marketplace with its equity, dumping the value built up on the various other URLs.

The hardback URL is now competing with 3rd party sites at a lower ranking potential. The result is that problems are compounded. Not only is the product receiving less traffic than it could, but traffic is landing on a URL that is not the most effective URL for converting the traffic. As sales of the hardback edition reach the maximum number of sales possible at its price point, the results of marketing spend will diminish, increasing CPAs.

One way of resolving this is to canonical the equity to one URL.

By condensing the equity of this product into one URL, it increases its ability to rank and capture traffic, effectively shifting out the PPF curve and helping to minimize cannibalization created by having multiple options on one page. And as the sales of the hardback edition hit diminishing returns, the incoming traffic can continue to be monetized at the lower price point. This extends SEO traffic out along the demand curve, allowing a larger number of customers to purchase the product at variable price points.

How Businesses Are Solving For This

Walmart

Walmart hasn’t resolved this problem, but has a bit of a band-aid solution in place. A search for “harry potter deathly hallows book” leads you to the hardback version of the book. When you arrive to the page from search, or a recommendation engine, the page loads a “People Who View This Item Also View” box at the top, which often features additional versions of the product, such as the paperback. However, it doesn’t seem to load when the page is accessed directly. If this bit of pseudo cloaking wasn’t in place, traffic landing on this page would only have immediate visibility to the higher $19.21 price point, instead of the $9.69 price point. This creates two problems. The first is that the paperback edition is receiving limited shelf space in search, affecting potential revenue maximization. The second is that the book’s equity, including links, reviews, content, and social shares are diluted across two URLs. This reduces the site’s ability to rank against competition reducing the top of funnel traffic coming in.

Overstock

The Overstock result for the same Harry Potter keyword has a larger problem. The organic result goes to the $46.95 audiobook with no visibility to the paperback or hardback editions. I’m willing to guess there is conversion drop off and lost sales happening here, as the hardback and paperback editions are $19.03 and $10.09 respectively.

Gamestop

Gamestop has a partial solution. The problem described in this post exists in the game industry by way of various console versions. This can create an IA nightmare when attempting to prioritize the right game. Gamestop resolves some of this problem by creating collection pages, such as this one for Assassin’s Creed III. This creates a “canonical” URL, which is used in internal links and features various platform versions. However, the problem still exisits, because when you search for “Assassin’s Creed III game” the PS3 version ranks #10. You can tell by comparing it to one of the Xbox versions that ranking equity, such as social metrics, are diluted across multiple URLs.

Gamespot

Gamespot’s team should be applauded for their solution. A solution that leaves them performing relatively well in search. The same search for “Assassin’s Creed III game” leads to a canonical Assassin’s Creed III URL . This is the definitive URL for the game and is platform agnostic. A number of tabs across the top drill into platform specific views of the game, such as the Xbox URL. However, a SEO will quickly notice this URL’s social share buttons have the exact same number of social shares as the canonical, platform agnostic URL. The platform specific URLs canonical using both the rel canonical tag and by having a canonical URL to share with social buttons across all versions of the game. They even define a canonical shortened URL in the Open Graph URL tag. This helps consolidate ranking equity into one URL.

Barnes & Noble

The Barnes & Noble team has a strategy similar to Gamespot’s. If you arrive to their product page, such as this one for Catching Fire, it is typically the hardback edition’s URL. However, this is a unified page that can swap calls to actions and pricing using parameters. For example, the canonical URL has a CTA and price for the hardback, with an upsell for the NOOK version. However, by passing a parameter to the URL, the hardback CTA falls off leaving a primary call to action for the NOOK version. However, the number of reviews and the social shares on the page are the same. This is because this parameter URL for the NOOK, audio, and paperback editions all canonical to the primary URL. They do this with the Open Graph URL, the rel canonical, canonical content, and through canonical social share buttons. Like Gamespot, they’re consolidating ranking equity into one URL.

Solving Beyond SEO

Although the examples above can be presented as technical SEO challenges only, they can play larger strategic roles in business and marketing planning. Companies like Barnes & Noble can use their established footprint in book title search results to grow their NOOK business. They can do this without creating differentiated pages, minimizing marketing spend opportunity costs. Or companies like Netflix were able to use their imperfect solution of a singular movie page on their movie subdomain, which can drive traffic to both their DVD and streaming businesses. A differentiated DVD and streaming page could have cannibalized each other for the same keyword. Some companies struggle, such as Best Buy, who don’t have a solid solution. They seem to link to and spend ad money against search result pages, allowing other domains to gain substantial traction in search against them, despite their 92 domain authority and 40,000 linking domains.

The examples above can continue to maximize the area under the demand curve by using intelligent systems that learn consumer behavior and apply it to one canonical URL. This can help selectively price the same source of traffic in a way that maximizes revenue. A customer with no historical data may be more prone to purchase at a lower price point, while a logged in user with a history of purchasing NOOK or Kindle books may be more likely to convert on that call to action. A user who has purchased every copy of Harry Potter may be more interested in purchasing the hardback edition than the paperback. A system like Barnes & Nobles’ can further CRO their traffic by swapping their product CTAs based on learned behavior, but keeping it at one canonical URL, so situations of keyword cannibalization and macro level opportunity costs don’t arise.

This is a standard, although complicated, problem for websites selling different versions of a product. To a less extent, this is the same problem for products with multiple colors.

Really awesome introduction anyway, this makes the problem much more clear, and makes much more sense when talking about CPA.

“Assassin’s Creed III game”

This is really cool .. loved it!

I think you are comparing two completely incomparable things. The way a buyer see different edition of books is completely different from buyer of a game on different platforms.

Assassin’s Creed for Xbox is completely different from Assassin’s Creed for PS3. In this canonicalization doesn’t hurt Gamespot at all.

Similar canonicalization might hurt bookstore badly because a buyer might go for a cheaper option, just because it is available.

or i am missing it completely 😉

@Satish

Thanks for the comment!

I agree that they’re different issues, but both are the result of keyword cannibalization and limited shelf space. Both issues can interfere with profit maximization by hiding potential options.

And I agree, a decision based on price is different than one made on taste and platform (was trying to expand examples beyond just bookstores and price models). But in the gaming industry, searching for the title’s name alone is fairly typical. Customers don’t often define the specific console. For example, “assassins creed 3” gets 340 times more searches than “assassins creed 3 ps3” according to Adwords. This is typical of my personal experience looking at search volume of games.

In this case, having all of the generic traffic for “assassins creed 3” land on only one platform URL, without exposure to other platforms, would likely limit conversions.

And division cannibalization is certainly a fear, especially with different monetization models and different profit margins. But the reverse can be true. Fear of cannibalization could also prevent the growth of highly profitable divisions. A few examples would be the growth of the Kindle, the expansion of Netflix to streaming, and Apple growing beyond PCs and laptops to iPad and iPhones.

I think this is following on from Satish’s point above.

In the Gamespot example used, you mention that the team are to be applauded for their use of canonicalisation, but surely this isn’t solving the issue?

As long as the searcher is looking for the generic keyword (Assassins Creed iii) they are fine as there is one strong page that has all the platform specific pages canonicalised back.

But what if their query is “Assassins Creed iii for Xbox 360”? The chance of the platform specific page ranking well is essentially nil and the chances of the generic, platform agnostic page ranking well is diminished as a result of under-optimisation in the title tag and URL.

I think I prefer the option of showing the other closely related products available in a prominent position – unless I too am missing the point.

@Harry

Hey Harry, thanks for the comment.

I think the Gamespot team is solving it relatively well compared to many of the other sites attempting to address the problem in the same industry. I don’t do a lot of work in the core gaming space, but from my work in the casual space, game titles are frequently searched for by the title alone or some other non-platform specific modifier. In the casual space, it’s words like free, online, review, and download.

Every industry is unique and it might be a strategy question of if ranking for the platform specific terms is more valuable than consolidating that value and going after longtail terms that have nothing to do with platform.

I’m coming from a slightly bias position looking at game analytics all day, but amongst all the options, I’d go with Gamespot’s or B&N’s approach if I was in a gaming vertical. However, that could be horrible advice in some verticals where users might have different search behaviors.

In addition to the normal search issues keyword cannibalization can cause, now that Panda is on the loose there’s another, even worse problem:

Too many similar pages can cause a site to be devalued by Panda.

For that reason alone, it makes sense to avoid having too many pages on similar or duplicate topics.

Justin, I did the same before writing it. Assassins Creed iii is searched 300 times more than Assassins Creed iii for XBox & interesting thing is that Gamespot is even ranking top 10 for that :-).

I seriously applaud your thoughts & in SEO industry no idea works for all the industries & all the customers.

Love this.

Though I feel like Amazon.com has slowly been training all of us how to use its “formats” selections.

Satish’s question:

“But what if their query is “Assassins Creed iii for Xbox 360″? The chance of the platform specific page ranking well is essentially nil and the chances of the generic, platform agnostic page ranking well is diminished as a result of under-optimisation in the title tag and URL.”

Your answer was that the majority of searches in the gaming industry are not platform specific, so it is wiser to go after the general vs. specific (in SEO speak short vs. long tail).

I have two questions on that:

1. What of the innumerable long tail keywords? Do the ‘Assassin’s creed III’ searches outnumber all the long tail queries combined – for each of the platforms?

2. I’ve heard many SEOs say that more specific queries convert better since the guy who’s looking for “Assassins Creed iii for Xbox 360″ has a more specific intent than someone looking for ‘Assassin’s creed 3” alone. So you’re losing less, but more highly qualified traffic.

In either case, it’s still as you say a zero-sum game. You’re losing the long tail in order to capture the short tail.

I appreciate tying SEO to economics. It seems like this will be an increasingly talked about topic since there’s an attack on duplicate content with Panda but attempts to deal with it via canonicalization.

I’m curious to see how this will look when a company “figures this out” and handles it really well.

Thank you for this. Really well thought out and made me think about how we create and develop promotional packages (which convert better, but then dilute link equity) in our own business. Grouping products like that can be an issue.

If we already had all these pages created, would it be better to make one canonical and try to divert links to the canonical one (interally)?

This is superb – experience shows it’s a nightmare trying help clients to establish an understanding of this kind, and to really get the big picture and how all of their activity needs to tie together to not only maximise value gain/growth, but also to minimise the opportunity cost and cannibalisation.

I expect that these charts shall be making an appearance in a series of client presentations over the coming months!

Heavy at the start but I managed to make it to the end! I think for the gaming example it’s fine, because you can target “xbox” and “playstation” in your URL and title comfortably without it being forced.

E.g. “Assassins Creed – Xbox 360 and Playstation 3 – GameSpot”

If it was available on 10 platforms then you might struggle and have to compromise.

Never thought of this issue but it makes perfectly sense. Clever but yet simple solution. Great post Justin!

Any suggestions how you would deal with this ‘problem’ if you’re running a English version with the same productpage in several countries? What If Google.com en Google.co.uk gives you different positions in rankings although you implemented the canonical?

I think the one URL approach of BN is the superior one from a theoretical standpoint. But is it really working for them in the serps? Google “catching fire” and BN is nowhere to be seen. With such a strong brand you would think they would rank om the first page.